Project Background and Technology Foundation

Core Technology Overview

IONIX CHAIN’s technical architecture centers around what the project calls “Quantum AI Consensus,” a proprietary consensus mechanism designed to achieve high throughput and low latency. According to project documentation, the blockchain aims to process 500,000 transactions per second (TPS) with sub-second finality.

Key Technical Features

- AI-Driven Optimization: The protocol utilizes artificial intelligence algorithms to optimize network performance, security protocols, and resource allocation

- Cross-Chain Integration: Native interoperability features designed to facilitate communication with other blockchain networks

- Scalability Focus: Architecture specifically designed to handle enterprise-level transaction volumes

- Adaptive Smart Contracts: AI-enhanced smart contract functionality for improved efficiency and security

Decentralized GPU Marketplace

One of IONIX CHAIN’s notable features is its decentralized GPU marketplace, which allows users to monetize unused computing power. This addresses the growing demand for computational resources in AI development while creating additional utility for $IONX token holders.

Tokenomics and Economic Model

$IONX Token Utility

The $IONX token serves multiple functions within the ecosystem:

- Transaction Fees: Primary medium for network transaction costs

- Staking Rewards: Token holders can stake $IONX for network security and earn rewards

- Governance: Participation in protocol governance decisions

- AI Services: Payment for AI-powered services within the ecosystem

- GPU Marketplace: Compensation for computational resource providers

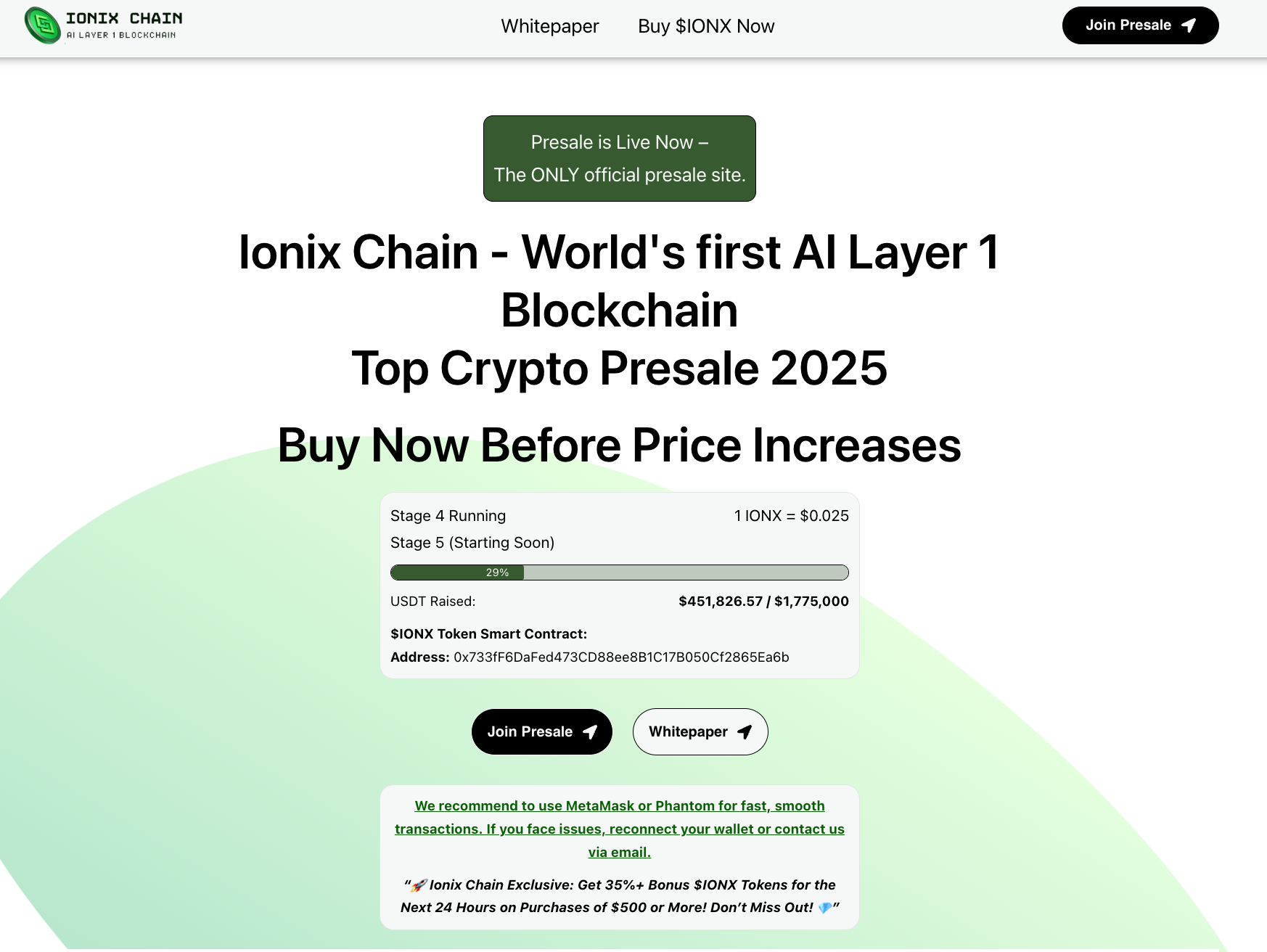

Presale Structure

As of late 2025, IONIX CHAIN is conducting a presale with the current price reported at $0.021 per token. The presale structure includes bonus incentives for larger investments, though specific tokenomics details regarding total supply and distribution remain to be fully disclosed in publicly available documentation.

Market Positioning and Growth Potential

Competitive Landscape

IONIX CHAIN operates in the highly competitive Layer 1 blockchain space, facing established competitors including Ethereum, Solana, Cardano, and numerous other protocols. The project’s differentiation strategy focuses on AI integration and high-performance capabilities.

Adoption Potential Factors

- AI Integration Trend: Growing demand for AI-blockchain convergence solutions

- Scalability Solutions: Market need for high-throughput blockchain infrastructure

- Cross-Chain Demand: Increasing importance of interoperability in the multi-chain ecosystem

- Enterprise Applications: Potential for institutional and enterprise adoption

Market Context: Beyond Meme Coin Speculation

While Solana meme coins and similar speculative assets often dominate retail investor attention, infrastructure projects like IONIX CHAIN target different market segments. The success of such projects typically depends on technical execution, developer adoption, and real-world utility rather than social media momentum.

Risk Analysis and Challenges

Technical Risks

- Unproven Technology: The “Quantum AI Consensus” mechanism lacks independent verification and real-world testing data

- Scalability Claims: Achieving 500,000 TPS while maintaining decentralization presents significant technical challenges

- AI Integration Complexity: Combining AI with blockchain technology introduces additional complexity and potential failure points

Market Risks

- Intense Competition: Established Layer 1 protocols have significant network effects and developer communities

- Regulatory Uncertainty: Evolving cryptocurrency regulations could impact project development and adoption

- Presale Stage: Project remains in early development with no mainnet launch or proven track record

Investment Considerations

- Limited Track Record: No historical performance data or proven use cases

- Transparency Concerns: Limited publicly available information about team backgrounds and technical specifications

- Market Volatility: High-risk investment subject to significant price volatility

Price Projections and Market Analysis

Valuation Framework

Analyzing IONIX CHAIN’s potential requires examining several factors:

- Technology Delivery: Success depends heavily on delivering promised technical specifications

- Developer Adoption: Long-term value tied to ecosystem development and usage

- Market Conditions: Broader cryptocurrency market trends will significantly impact performance

Growth Scenarios

Optimistic Scenario: If IONIX CHAIN successfully delivers on technical promises and achieves meaningful adoption, the project could see significant appreciation, potentially reaching market caps comparable to other successful Layer 1 protocols.

Conservative Scenario: Given the competitive landscape and execution risks, investors should prepare for potential challenges in gaining market traction, with returns dependent on broader market conditions and technical milestone achievement.

Investment Timeframe

Layer 1 blockchain projects typically require 2-5 years to demonstrate meaningful adoption and value creation. Unlike the rapid price movements often seen in Solana meme coins, infrastructure investments generally follow longer development and adoption cycles.

Roadmap and Development Milestones

Reported Development Phases

- Phase 1: Presale completion and initial token distribution

- Phase 2: Testnet launch and developer documentation release

- Phase 3: Mainnet deployment and core functionality activation

- Phase 4: Ecosystem expansion and partnership development

Note: Specific timelines and detailed roadmap information were not available in publicly accessible sources at the time of this analysis.

Comparative Analysis: Infrastructure vs. Speculative Assets

IONIX CHAIN vs. Meme Coin Investments

| Factor | IONIX CHAIN | Solana Meme Coins |

|---|---|---|

| Investment Thesis | Utility and infrastructure | Speculation and community hype |

| Time Horizon | Long-term (2-5 years) | Short to medium-term |

| Risk Profile | High (execution risk) | Very high (speculative risk) |

| Value Drivers | Technology adoption, utility | Social sentiment, viral marketing |

Investment Recommendations and Due Diligence

For Potential Investors

- Conduct Independent Research: Verify all technical claims and team credentials through independent sources

- Assess Risk Tolerance: Consider this a high-risk, speculative investment suitable only for risk-tolerant portfolios

- Diversification: Avoid overexposure to any single presale or early-stage project

- Technical Due Diligence: Review whitepapers, code repositories, and technical documentation when available

Red Flags to Monitor

- Lack of transparent team information

- Unrealistic technical claims without proof-of-concept

- Absence of code audits or third-party verification

- Limited community engagement or developer interest

Conclusion: Navigating Infrastructure Investment in 2025

IONIX CHAIN ($IONX) represents an ambitious attempt to combine artificial intelligence with blockchain technology in the competitive Layer 1 space. While the project’s technical specifications appear impressive, investors must carefully weigh the significant execution risks against potential rewards.

Unlike the rapid speculation cycles often seen with Solana meme coins and similar assets, infrastructure projects like IONIX CHAIN require patient capital and long-term commitment. The project’s success will ultimately depend on its ability to deliver on technical promises, attract developer adoption, and compete effectively against established blockchain protocols.

Key Takeaways:

- IONIX CHAIN targets enterprise-grade blockchain infrastructure rather than speculative trading

- The project’s AI integration and high-performance claims require careful technical verification

- Investment timeline should be measured in years, not months

- Success depends on execution, adoption, and broader market conditions

As the cryptocurrency market continues to mature, distinguishing between speculative assets and potential infrastructure investments becomes increasingly important. IONIX CHAIN offers an interesting case study in how AI-blockchain convergence projects are approaching the market, though only time will tell whether such ambitious technical goals can be achieved in practice.

This analysis is for educational purposes only and should not be considered financial advice. Cryptocurrency investments carry significant risk, and investors should conduct their own research and consider their financial situation before making investment decisions.